This is part of a sponsored collaboration with The College Board and DiMe Media. However, all opinions expressed are my own

My high school senior year photo. By this time, I knew I was going to attend Florida Int’l University and happy to have financial aid to cover it.

Having the college money talk can be nerve-wracking, not only for the big sums of money in question, but also the fact that decisions made now in your 17-year old’s life can affect their the rest of their lives. No pressure, right?

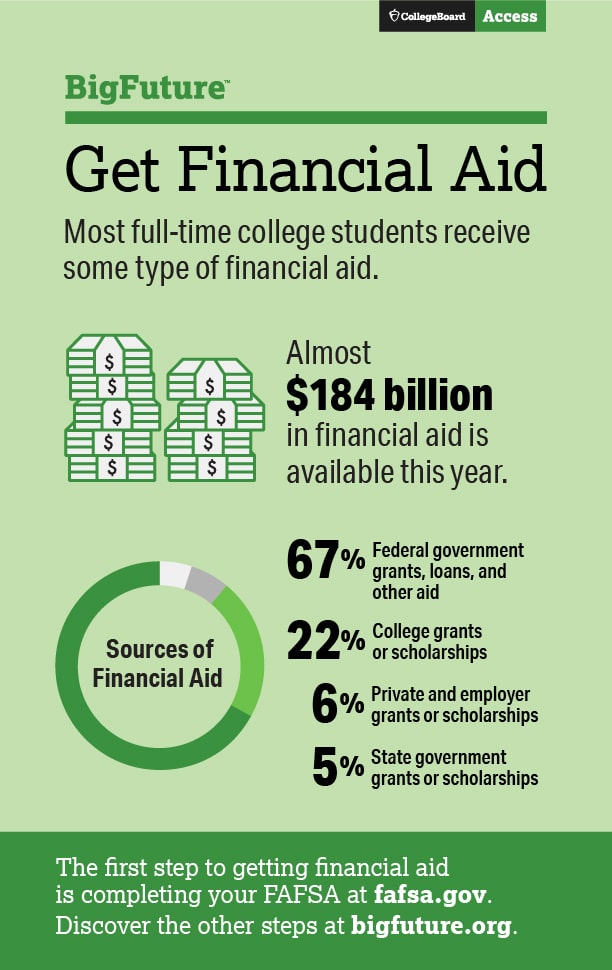

Financial aid can help alleviate the money burden and even enable him/her to go to a school you thought you couldn’t afford.

Federal student aid programs include grants (free), loans (need to be paid back after graduation) and work-study programs (usually on-campus) from the federal government to eligible students enrolling in college.

The government considers eligible U.S. citizens who show a financial need (difference between the cost of college attendance and Expected Family Contribution) who will be enrolled in an eligible degree or certificate program at a college or career school.

Applying for Federal Aid

In order to apply for these, the first step is to complete the Free Application for Federal Student Aid (FAFSA), which can be filled out online or you can download the application and send via mail.

Even though the FAFSA is used for federal aid, many state governments and colleges use it to award their own aid so even if you or your spouse makes more than $100k a year, you are still encouraged to apply.

Even though the FAFSA is used for federal aid, many state governments and colleges use it to award their own aid so even if you or your spouse makes more than $100k a year, you are still encouraged to apply.

Filing the FAFSA as early as it’s available on the first week of October during your teen’s senior year is a good idea so you can get a jump on other financial aid applications (state or institutional aid) that may have early deadlines.

Also, getting in early can help your college-bound teen get more money from the financial aid pie – as there’s more money available at the beginning of the year. In order to quality for financial aid for the fall semester, check each state’s application deadline HERE.

1. Before you apply, you’ll need to create a FSA ID and collect the documents you need to get started.

2. Make sure you have your recent tax returns handy in order to complete the FAFSA application online.

3. Read “How to complete the FAFSA”

4. Visit fafsa.gov to complete the application and wait to get the Student Aid Report (SAR), which takes just a few weeks.

What to do after filling out the FAFSA

After your teen has filled out the FAFSA, is a good idea to keep applying to private and state-run scholarships, as well as aid found directly within the schools he/she is applying for. Also important to note that the FAFSA must be filled out every year the student is enrolled in college (and you may receive different aid year after year).

Also, you may want to send your FAFSA to a few colleges (not only your teen’s top choice) as colleges know if the student has sent it around and if he/she is a good student, they may offer additional aid to compete with the others. Remember colleges are businesses too.

Free online resources to help plan for college:

1.To learn more about paying for college, including finding scholarships visitBigFutureor download the CollegeGo app.

2. Students can use BigFuture to search for and compare colleges, find scholarships, understand financial aid, navigate the college application process from start to finish, and receive personalized deadline reminders, tips, and guidance along the way.

3. The CollegeGo mobile app guides students through the essential steps in the college application process with an interactive interface that uses game, video, and search features to help students plan their college journeys.

4. Read: “7 Things You Need to Know about Financial Aid”

5. The College Board has also created Spanish language resources for parents and families to help their children plan for college.

a. Family Action Plan_11th Grade Spanish

b. Family Action Plan_12th Grade Spanish

Visit fafsa.gov for important information and resources.

Anllelic Lozada “Angie” is a proud P.A.N.K (professional aunt with no kids), a Personal Marketing Strategist in NYC and Los Tweens & Teens “Tia-in-Charge,” based in New York City. Anllelic wants you to best your best life so you can positively influence your tween and teen. Subscribe to her weekly e-newsletter in Spanish in marketingparatucarrera.com/Vendete, where she shares personal marketing strategies to help you “Comunicar lo genial que eres.”